(Downloadable spreadsheet available for download on SMART Forums)

The one question you must ask yourself as a businessperson – are you a finance person?

Before you read this article, I need you to answer one question. Who is the finance person in your business? Is it your accountant? Your admin person? Or perhaps it’s your salespeople, those who push your product or services. Not sure? Do you need a hint? Turn the screen off for a moment and you’ll have your answer.

YOU are a finance person. Everyone in your business is a finance person. Every decision in business affects business finance. To understand finance, you need to understand numbers.

Nearly every decision in our lives revolves around numbers. Numbers drive your appointments and deadlines. Your house or office stands today because of an Engineer’s numbers. Doctors measure your heartbeat and blood pressure – numbers. You’ll hear so many numbers as we lead up to the Federal Election on July 2 – and yes, you guessed it – numbers will decide who wins.

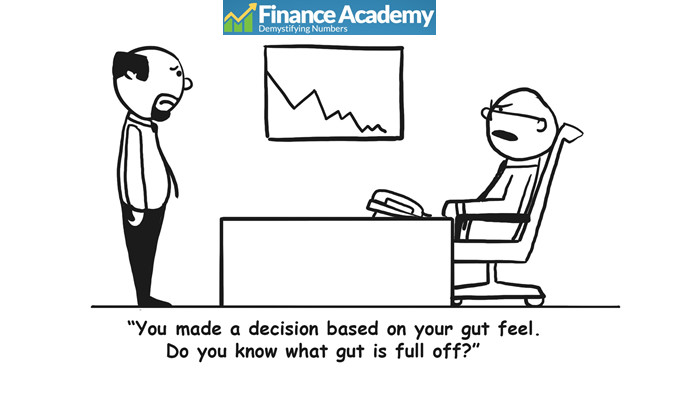

So are you making business decisions based on numbers? Or are you making decisions using assumptions? You know, what your “gut” or what “common sense” tells you.

The question we need to answer now is why people are uncomfortable looking at their numbers in business. Three major reasons are:

- A lack of clarity or awareness. They have many misconceptions about numbers. People think it’s simply their accountant or finance controller’s job to keep on top of it.

- Because they think learning about finance will involve a lot of jargon and complicated terms.

- It’s a confronting subject: numbers don’t lie.

So let’s field the first question – it’s due to a lack of clarity, or a head full of misconceptions. If you think numbers are someone else’s problem then you are making business decisions based on assumptions.

In other words, this is just you hoping, wishing and praying your decisions bring your business profit.

This is the biggest myth in business, and it’s long overdue to be busted: “I am in business, but I am not a finance person.”

In business, everyone is a finance person. The core principle of good financial management is this:

“The ability of everyone in the business to understand the impact of every decision they make and take action ONLY if it adds to the business’ bottom-line.”

If you think your decision has the power to affect the bottom-line (profit), then you are a finance person!

Let’s put it into perspective. Let’s say a sales person sells pens for $10. A potential client wants 100 pens but their budget is only $800. That means that sales person should now sell their pens for $8 apiece. The decision the sales person makes isn’t just a sales decision but a finance decision. Why? Because it affects the bottom-line.

If a clothing shop’s Retail Manager needs to shift unsold stock, as new stock will be arriving soon, they might discount current stock by 15% or 25%. This isn’t just a practical decision or a Retail Managers’ decision. It’s a finance decision because it too affects the bottom-line.

Say you want a coffee and go to a café. If the barista just takes your order and doesn’t upsell you a delicious cookie or snack of a day, or just goes on with their job without prompting a good conversation, then you may not visit that cafe again. These are decisions the barista takes and they all affect the bottom-line, now and into the future.

It’s all about the bottom-line!

So think about it – are you still a finance person? If not, then please tell me the answer to this question: what is the difference between finance and accounting? I trust your answer will reach me via telepathy!

Until next time,

(Definitely a) Finance Person and Financial Educator at Finance Academy