In business, you have two basic financial statements,

1. The Balance Sheet, and;

2. The Profit & Loss Statement.

Profit & Loss statement is like a thermometer – it tells the temperature of a business. On the other hand, a Balance Sheet will tell us why a business has got that temperature. (Assuming we know how to read them both to get the complete picture)

You may have heard about – or even use Profit & Loss Statement in your own business. Profit & Loss Statement is also known as:

- P & L Statement

- Income Statement

- Statement of Earnings

- Statement of Operations

- Operating Statement

- Revenue and Expense Statement

In my last article, I explained how to read a Balance Sheet using a simple story. (You can read it later by clicking this link). Let me use the same story to explain Profit & Loss Statements.

Quick flashback – Imagine a veteran football player called David. David retires from professional football and wants to start a business. David decides to start a sport store that will exclusively sell football equipment and accessories. He names the business David’s Football Store (DFS).

A Profit & Loss statement has two headings – Expenses and Incomes. I usually refrain from using jargon, Expenses are ‘Outflow of Money’ and Incomes are ‘Inflow of Money’ (In – comes, money comes-in)

Let us imagine the following for DFS:

- It operates in a rented property;

- It has three staff members, including David;

- It has taken a loan from the bank;

- It has engaged a marketing consultant to help promote the business on social media;

- Uses a part-time bookkeeper and accountant;

- Sells football accessories, and;

- Occasionally makes money when David coaches a local team.

Now, I would like you to quickly list on paper or in your mind the list of Expenses and Incomes for DFS business.

Give a pat on your back if you have listed the following under Expenses:

Sales / Revenue – Money a business makes from its core business activity.

Other incomes – Money a business makes outside its core business activity.

In this example, when DFS makes money by selling football accessories it would be recorded under Sales / Revenue.

However, DFS sometimes makes money when David coaches his local team. Again, money comes in to the business but this is outside his core business activity. The bookkeeper records this as ‘Other Incomes’.

Remember, if a business is making majority of the money through ‘Other Incomes’ instead of ‘Sales / Revenue’, it is a matter for concern. The reason is simply that David started DFS to sell football accessories, not just coaching services. I am not suggesting David should stop making money coaching; the point I am trying to make here is DFS should not mix both incomes (from sales and other incomes) under one. If there is potential to make good money by coaching then we would suggest David to treat it as a separate business.

“What gets measured gets managed.” – Peter Drucker

Profit & Loss Statements are always prepared for a specific period. In general, it is prepared for one financial year and is headed: Profit & Loss Statement for the year ending.

If the company has opted for an IPO (initial public offering) and is offering shares on the stock market, then it is compulsory for them to produce their Profit & Loss Statement every financial quarter (every three months). So, the heading would be Profit & Loss Statement for the quarter ending.

Some companies prepare Profit & Loss for every month – or every week – depending on the number of financial transactions happening in that particular business.

The main intention preparing Profit & Loss Statement is to know if a business is making profit or not at any given point in time. It still worries me when I see people in business making decisions based on assumptions instead of referring to latest financial statements. Then they pray and hope to make profit in business. Friends, hope is a good thing to have but it is not a good strategy to run a business!

Anyways, back to the article.

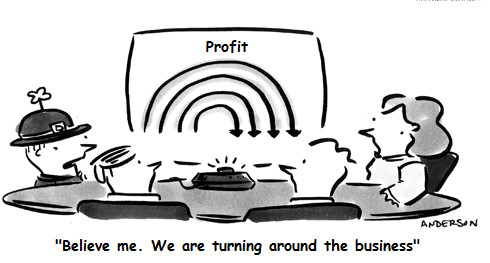

Let me introduce bit of jargon, when it comes to accounting – Sales is called ‘Top Line’ and Profit is called ‘Bottom Line’.

Do you know why bottom-line is called bottom-line?

Answer: Because it is the bottom most line!

Finance is a common-sense subject – so please use it when you are reading financial reports.

Click here to register for our ongoing SMART Finance Masterclass Webinar Series.

In my next article, I will explain the two most commonly used yet misunderstood terms – Credit & Debit.

Meanwhile, it might sound old school – but ask yourself if your business is making more money than it is spending by understanding your Profit & Loss Statement.

Cheers!

Chinmay Ananda